Budget & Taxes

Taxes

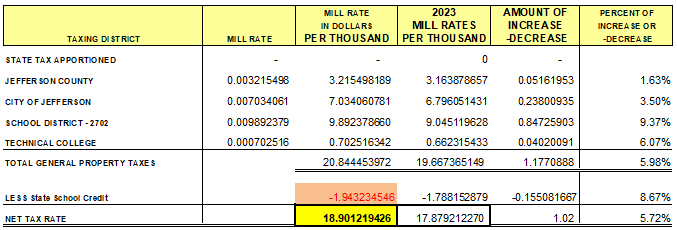

Current Year (2024)

Prior Year (2023)

Real Estate Tax Bills Personal Property Tax Bill

Prior Year (2022)

Real Estate Tax Bills Personal Property Tax Bill

Prior Year (2021)

Real Estate Tax Bills Personal Property Tax Bills

Prior Year (2020)

Real Estate Tax Bills Personal Property Tax Bills

Prior Year (2019)

Real Estate Tax Bills Personal Property Tax Bills

Prior Year (2018)

Real Estate Tax Bills Personal Property Tax Bills

(Bills can be viewed and downloaded in pdf format)

Tax payments may be made three different ways: In Person, By Mail and Electronically.

In Person

You may pay your Real Estate Taxes in person at Jefferson City Hall, 317 South Main Street, Monday through Friday from 8:30 a.m. to 4:30 p.m. (Please note that the second installment goes to Jefferson County, 311 S. Center Ave, Jefferson, WI 53549)

**To have your tax bill recorded in the current year, please visit us in person prior to January 1st OR drop your payment in the silver (utility) box outside our Dodge Street entrance with a December check date (up until January 1st), mail with a postmark date of December 31, make a payment on-line on the 31st of December (or prior).

By Mail

All tax payments can be made by mail.

To receive a receipt of your taxes via mail, you MUST enclose a self-addressed, stamped envelope.

Receipts may also be obtained by stopping into City Hall.

Your envelope MUST be postmarked in December 2024 to have your payment credited to 2024. We do not accept the date on your check (unless you drop it in the silver drop box at our Dodge Street entrance the weekend of December 31)

Electronically

Once again, the City will have electronic collection of tax bills. This will allow you to use your credit or debit card for the payment of your taxes. However, this service will charge you a 3% “convenience charge” on the amount being paid. The convenience charge is collected by Official Payments and is NOT collected by the City of Jefferson. The City of Jefferson WILL NOT receive any portion of the 3% convenience fee. (You must enter a six digit code for your tax bill. This is your tax bill number with the appropriate number of ZEROs in front of it. If your bill number is 306, enter 000306.)

DO NOT USE THIS LINK FOR PAYMENT OF THE SECOND HALF OF TAXES. THIS IS ONLY FOR PAYMENTS MADE PRIOR TO JAN 31.